Nvidia earnings offer little cheer for tech shares

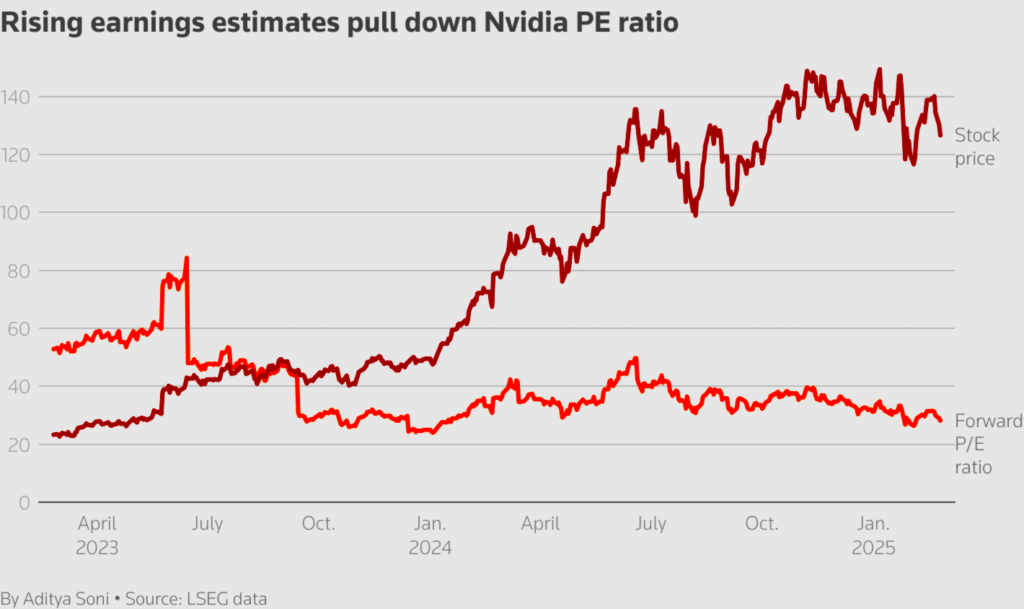

Nvidia’s latest earnings report has once again demonstrated its dominance in the AI semiconductor industry. With a forecasted sales of $43 billion for the next quarter, the corporation surpassed analyst forecasts and reported an amazing 78% increase in quarterly revenueDespite these impressive numbers, the market has responded rather subduedly.After rising 3.7% during regular trading hours, Nvidia’s shares dropped 1.5% during extended trading. The wider tech sector has reacted in a similarly muted way, raising the question of whether concerns about AI spending and competition from China’s DeepSeek are gaining traction

Nvidia’s Profits in Brief

Nvidia reported record-high sales of $130.5 billion for its fiscal year, demonstrating its continued ability to capitalize on the demand created by AI. With a net income of $22 billion, the fourth quarter alone generated $39.3 billion in revenue. Nvidia’s flagship Blackwell AI chips primarily drive the demand for AI chips in data centers, largely fueling this remarkable rise.

Nvidia’s margins are getting thinner in spite of these impressive figures. The company’s gross margin dropped from 73.5% to 71%, which was just less than the 72.2% analyst had predicted. The exorbitant expenses of increasing manufacture of its Blackwell AI chips are the cause of this drop.

Important Points to Remember:

Revenue for the quarter: $39.3 billion (up 78% year over year) $22 billion is the net income. Revenue for the entire year: $130.5 billion Projected Q1 revenue: $43 billion (above analyst estimates) Gross margin: 71% (down from 73.5%) Stock movement: -1.5% in extended trading

Market Reaction: What’s Holding Tech Stocks Still?

Even while Nvidia’s profits were unquestionably impressive, tech investors were not as excited by them as they should have been. The larger tech sector, which includes important Nvidia clients like Amazon, Microsoft, Alphabet, and Meta, stayed mostly stable. In Asia, South Korean chipmakers Samsung Electronics and SK Hynix saw declines of 0.18% and 1%, respectively, while shares of Taiwan Semiconductor Manufacturing Co. (TSMC), a major supplier to Nvidia, lost 0.47%.

The following elements influence the tepid response:

- The Revolutionary AI Model of DeepSeek

The emergence of China’s DeepSeek is among the main worries plaguing investors. The business recently unveiled a low-cost AI model that is said to compete with the best AI technologies available in the US. This event raised concerns about a potential slowdown in expenditure on Nvidia’s high-end AI hardware. One of the worst stock losses in history occurred in January when word of DeepSeek’s innovations destroyed over half a trillion dollars of Nvidia’s market worth in a single day.

- Concerns About AI Spending

Massive infrastructure investments have been fueled by the AI boom, but some investors are concerned that the expenditures may not be sustainable. Microsoft, one of Nvidia’s largest clients, may be reevaluating some of its data center agreements, according to a recent analyst report. This has made others wonder if there would soon be less demand for Nvidia’s AI chips.

- The Seven Magnificent Stocks Under Stress

Since the emergence of AI technology, the stocks of the so-called “Magnificent Seven”—Nvidia, Microsoft, Amazon, Alphabet, Meta, Apple, and Tesla—have experienced tremendous growth. However, the Roundhill Magnificent Seven ETF has lost over 11% since mid-December, indicating that these equities have lately fallen from their late-2024 heights.

The Competitive Advantage of Nvidia: Continues to Lead the AI Race

Nvidia is still the clear leader in AI computing in spite of these reservations. Cutting-edge AI model training requires its powerful GPUs, and its strong alliances with tech behemoths like Microsoft, Amazon, and Meta guarantee steady demand.

The Reasons Behind Nvidia’s Strength:

- The advantage of being the first

As the leading supplier of GPUs for AI applications, Nvidia has a substantial advantage in AI computing. Nvidia’s hardware and software ecosystem is still unrivaled, despite rivals like AMD and Intel attempting to catch up.

- Superior Processing Capabilities

Even though DeepSeek and other businesses are creating more affordable AI solutions, tremendous processing power is still needed to train state-of-the-art AI models. The industry standard for high-performance AI applications is still Nvidia’s GPUs.

- AI development is only beginning

We are only at the beginning of the AI revolution. Nvidia is well-positioned to gain from the long-term adoption of AI across a variety of sectors, including as healthcare, banking, and autonomous driving, as digital titans prepare to invest heavily in infrastructure.

- Expansion of Strategic Production

Despite supply chain issues, Nvidia has effectively increased manufacturing of its new Blackwell processors, guaranteeing that it can satisfy rising demand. To ensure a consistent supply of high-performance GPUs, the business is collaborating closely with TSMC.